What is Auditing(Audit meaning & Defination)

Hey, do you know ‘What is Auditing?’ or Audit meaning, Auditing is a process of conducting step by step checks of business accounts. So that the business owner knows why and where he suffered the loss in the business. Auditing in accounting can be done by the internal auditor and external auditor. So that a firm can get an accurate and fair representation of the transactions that they claim to represent. So let’s discuss more…

Audit meaning – Know What is Auditing?

To understand auditing we will take an example, suppose Mr. Albert is the owner of a shop. And he is an independent sole proprietor of the business. This means that he is freely investing money in his own business and receives all the benefits alone. There is no shareholder and no other partnership in business.

So if MR Albert is the sole Business Manager then he has to be very attentive to his business. And they found that the percentage of the deficit is increasing day by day. So Mr. Albert started looking, and he found that there are 3 stages in his business where a lot of money is spent. Such as the purchase of goods, stock of goods, and sale of goods. And each of these three steps involves cash and check. It is easy to track if a check is involved. But if cash is involved. Then the transaction is a bit harder to track.

So there is a possibility of loss at various stages when buying, stocking, and selling goods. But how can Mr. Albert analyze?

- So he can check the checks used for sales and purchases

- Check the business’s staff

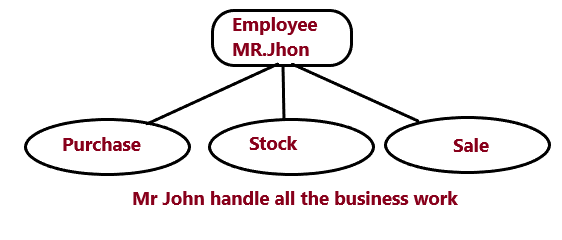

So they found that the check and bank entries were correct, now it’s time for the employee to turn up. Then he has only one employee Mr.John to handle sales, purchases, and stock. So there is a possibility that Mr. John is making mistakes. Because if he is buying and creating invoices and stocking and selling products. This means that Mr.John is doing something wrong which is causing losses. So let’s see what Mr. John can do to destroy the business

Possibility of Fraud done by Mr.John

- He can show Mr. Albert that he has bought more than the actual amount of the purchase

- He can create fake invoices for purchase and sale etc so that he can keep money in his pocket.

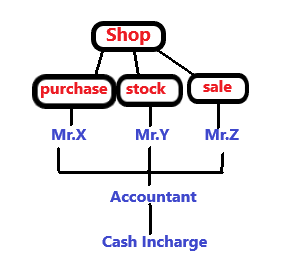

To reduce this risk, MR.albert hires more employees to classify their business functions and accounting? as shown in Figure…

Divide Business Work Between Employee

- As all the purchasing related work given to the Mr.x

- And all stock related work was given to the Mr.Y

- Then all the sells related work given to Mr.Z

- And to handle all accounting he hires an accountant but he is not involved in cash related work.

- And one more employee hires for cash related work.

So what will happen now, if Mr. Mistress makes a mistake, he will easily notice the mistake. And if Mr.Y will try to make a mistake. Then it will be seen by Shri. So we mean that no person can cheat the business. And if someone tries to do it, he will easily catch on to the next stage.

After classification, CA advises that now you have to check all accounts. To do this, Mr. Albert has chosen an independent firm to investigate all accounts that have nothing to do with this business. Then he will check all the Journal entries, vouchers, and supporting vouchers. And not only accounts, but he will also check the terms of the physical business in the accounts. And he will also check the profit and loss account or trial balance. These investigations of business accounts are called Auditing. And remember one thing, auditing can only be done by CA. So we hope that you have now understood well what is auditing in accounting is by this beautiful example. And now let’s see

Types Of Auditing In Accounting

If you already know ‘what is auditing’, then it’s time to know the types of auditing. There are various types of auditing, that can help you in removing losses and find any mistakes. Let’s see below types of auditing

Internal Audit: This can be performed by the internal staff and by the owner itself. So that you can improve your goal and make sure your business is compliant with laws and regulations. Further, this audit report can be sent to the shareholders and board members to get updates regarding the business’s finances.

External Audit: This audit can be done by an independent firm like CA or IRS. that has no relation to your business. They are experts in accounting so they examine each entry in the accounts whether its voucher or journal entries. After examining the ensure, your accounts are fair and accurate.

Audit Report: After auditing whether it’s done by an internal auditor or external auditor. the business auditor provides you an audit report. This report includes all the details about the mistakes found during the audit process.

IRS Audit in Accounting: In this auditing, your auditor examines your tax paid account. They ensure that you are not paying over tax and not paying undertaxed. And provide you details regarding your business tax return.

Financial Audit: Most of the financial audit is done by the external auditor. The auditor checks all your trial balances to journal entries and balance sheets. During auditing, the auditor analyzes your business account accuracy.

Operational Audit: Operational audit is generally conducted by the internal auditor but it can be done by an external auditor. Operation auditing is similar to internal auditing. The purpose of this auditing is to check the business internal planning process, operation results, etc.

Some More about Audits:

Compliance Audit: Compliance Audit in business helps you to identify that does your business policies follow the IRS guidelines or not. and also regarding labor compensation or shareholder distribution policies are a match to the IRS.

Payroll Audit: Payroll auditing helps you to check, are you not overpay to the employee or underpay to the employee. During this process, the auditor should check the pay rates, wages, taxes, and employee information.

Importance Of Auditing

Every business whether its small or mid or large business owner should conduct auditing on a regular basis. Because auditing finds mistakes in your business whether it’s in accounting or planning. The auditor catches the errors before they turn into any big issue. If a business owner didn’t do auditing then it can cause a big loss in the company.

So let’s see why auditing is important in accounting

- Audit help to find financial problems

- It’s boost business bottom line

- Also, catch minor mistakes

- Help to make better business decisions

- Help you to identify any fraudulent activity in accounting.

- Provide accurate cost of capital to business members. So that we can decrease the risk of investment.

Conclusion

Here this blog was about what is auditing, and types of auditing. Auditing is the most useful procedure. Because via this business owner comes to know why he gets losses while the sale is going on. And save you from the big losses. So that you can grow your business fast. We hope this blog will help you enough.

Recent Posts

Categories

Recent Posts

Intuit QuickBooks Tool Hub Download & Install

December 8, 2021

How To Resolve Quickbooks Error 1603

June 8, 2020